Business performance in the Segments

Segment Metal Refining & Processing

Key figures

| in € million | 2017/18 operating |

2016/17 operating |

| Revenues | 10,407 | 9,866 |

| EBIT | 359 | 347 |

| EBT | 353 | 337 |

| Capital expenditure | 152 | 161 |

| Depreciation and amortization | –118 | –119 |

| Operating ROCE | 19.4 % | 20.9 % |

| Capital employed | 1,852 | 1,657 |

| Number of employees (average) | 4,473 | 4,423 |

Business performance and earnings trend

The main factors driving earnings in Segment Metal Refining & Processing (MRP) are treatment and refining charges (TC/RCs) that are negotiated as deductions from the purchase price of the metals for converting raw materials and recycling materials into the exchange product – copper cathodes – and other metals. Additional earnings components include revenues from precious metal and sulfuric acid sales, as well as the metal gain. Furthermore, the Aurubis copper premium and the so-called product surcharge charged for processing copper cathodes into copper products are also significant earnings components.

During the fiscal year, Segment MRP generated operating earnings of € 353 million (previous year: € 337 million). Operating EBT during the previous year had been impeded to the tune of around € 15 million due to a scheduled maintenance shutdown carried out at the Hamburg site in Q1 2016/17.

Higher concentrate throughputs due to the Hamburg and Pirdop smelter sites’ good performance, substantially increased refining charges for copper scrap with a good supply, higher sulfuric acid revenues owing to considerably higher sales prices, higher metal recovery with increased copper prices, considerably higher rod sales, and positive contributions from our efficiency improvement program all had a positive effect on the result in fiscal year 2017/18. The weaker US dollar had a negative impact on earnings.

Overall, Segment MRP raised its operating result by 4.8 % in the reporting year, to € 353 million (previous year: € 337 million). The result was therefore at prior-year level and thus fulfilled the original forecast from the Annual Report 2016/17. Unscheduled maintenance shutdowns at the Hamburg and Lünen production sites in Q4 2017/18 negatively affected earnings and led to a slightly lower result than was expected when the Quarterly Report on the First 9 Months 2017/18 was released.

At 19.4 % (previous year: 20.9 %), the Segment’s ROCE was at the very high level of the previous year and likewise fulfilled the full-year forecast from the Annual Report 2016/17.

Segment MRP generated total revenues of € 10,407 million during the reporting period (previous year: € 9,866 million). This increase in revenues is primarily due to higher copper prices.

Raw material markets

Satisfactory treatment and refining charges for copper concentrates

There was a continued good supply situation for copper concentrates in fiscal year 2017/18, due especially to higher output volumes from mines and isolated shutdowns at other copper smelters. The copper price, which has risen notably compared to the previous year, served in the reporting period as a strong incentive for the mining industry to maximize output and push additional mine expansions forward. Aurubis also benefited and was able to procure a sufficient supply of copper concentrates in the reporting year.

According to Reuters, a leading mining company and a larger Chinese copper smelter signed the first significant annual contract for 2018 at benchmark TC/RCs of US US$ nbsp;82.25/t / 8.225 cents/lb (previous year: US;US$ nbsp;92.50/t / 9.25 cents/lb). Initially, a lower level was established for spot transactions in early 2018; toward the end of fiscal year 2017/18 in particular, spot TC/RCs then rose to levels above the benchmark TC/RCs for calendar year 2018. The main reasons for this were, on the one hand, the good copper concentrate supply situation due to high mine output and, on the other, the fact that discussions between mines and unions regarding collective agreements went smoothly and didn’t lead to any significant strikes. Furthermore, demand for copper concentrates among smelters, especially in Asia, decreased due to standstills and limitations of production.

Refining charges for copper scrap remain high

During fiscal year 2017/18, European refining charges for copper scrap were, in our opinion, at a relatively high level, with positive effects on our result accordingly. The following develpments influenced the market: At the start of fiscal year 2017/18, refining charges for copper scrap in Europe were at a very good level. As the fiscal year continued, negative weather-related influences on refining charges and then higher demand from China for copper scrap with high copper contents were noticeable on the market. This was countered by the higher supply of recycling materials from the US in Europe due to the trade conflicts between the US and China. All together, these developments led to a slight tightening of the market. Because of our flexibility with respect to input materials, we nevertheless had a sufficient supply for our production facilities.

The availability of complex recycling materials, including industrial residues and electrical and electronic scrap, was stable despite intense competition for these materials.

Production

Throughput slightly above the very good previous year

The good supply of copper concentrates, copper scrap, blister copper, and recycling materials ensured that our production facilities were well utilized during the entire fiscal year 2017/18.

The good performance of both the Hamburg and Pirdop smelter sites led to concentrate throughput of 2,522,000 t, which was 4 % above the very good previous year. The optimization measures from the Fit for Future program took full effect in Pirdop for the first time.

Concentrate throughput in Hamburg in Q3 2017/18 was influenced by a scheduled repair standstill in the anode furnace. Moreover, unscheduled shutdowns at the Hamburg and Lünen production sites in Q4 negatively affected the result for the year. The prior-year concentrate throughput was strained by the scheduled maintenance shutdown at the Hamburg site in Q1 of that year.

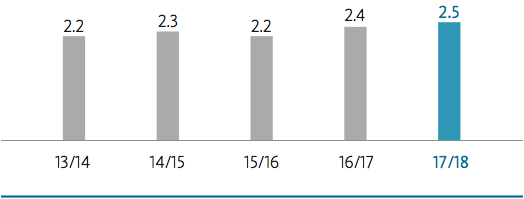

Concentrate throughput

in million t

At the recycling plant in Lünen, the throughput in the Kayser Recycling System (KRS) was at the level of the good previous year as a result of our input mix and the availability of recycling materials.

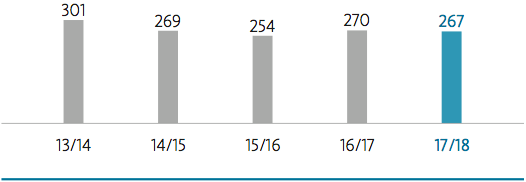

KRS throughput

in thousand t

The Olen site also has recycling facilities and a tankhouse for the production of copper cathodes. During the reporting year, both recycling sites benefited from the good refining charges for copper scrap, blister copper, and other recycling materials. Overall, the group-wide input of copper scrap and blister copper in fiscal year 2017/18 remained at the good prior-year level.

Copper scrap and blister copper input in the Group

in Tsd. t

Sulfuric acid output at prior-year level

Corresponding to the concentrate throughput, the sulfuric acid output was 2,374,000 t, slightly above the prior-year level. The global market for sulfuric acid was characterized by consistently high demand. The overall availability of sulfuric acid was very limited, a situation that was reinforced by isolated smelter shutdowns, especially in Asia. This led to substantially higher prices on the spot market in the reporting period.

Stable cathode output

The cathode markets recorded good ongoing demand with slightly improved spot premiums in reporting year 2017/18. At US$ 86/t, the Aurubis copper premium for calendar year 2018 was the same as in the previous year. We were generally able to implement this premium for our products in the reporting period.

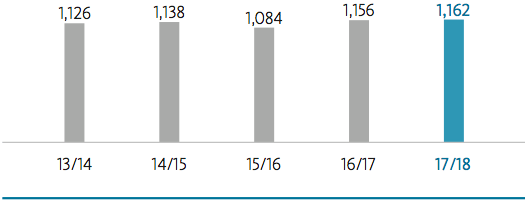

Copper cathode output in Segment Metal Refining & Processing was 1,162,000 t in the reporting year and was thus slightly above the prior-year level of 1,156,000 t.

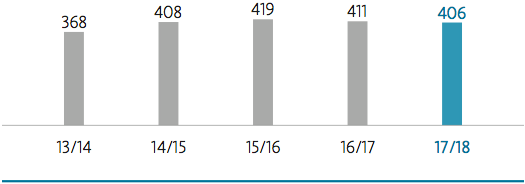

Cathode output in the Group

in thousand t

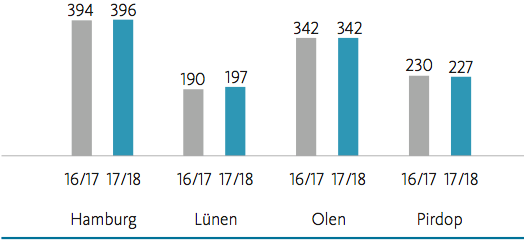

Cathode output in the Group by sites

in thousand t

Our new, diverse approach: multi-metal

Within the scope of our multi-metal strategy, we have been reporting sales volumes for lead, nickel, tin, minor metals, and platinum group metals since the start of the fiscal year, in addition to gold and silver.

The recovery of our metals depends on the metal contents in the processed copper concentrates and recycling materials. A portion of the metals is sold in the form of intermediate products.

| 2017/18 | 2016/17 | ||

| Gold | t | 48 | 42 |

| Silver | t | 877 | 1,026 |

| Lead | t | 19,527 | 19,624 |

| Nickel | t | 3,022 | 2,828 |

| Tin | t | 1,851 | 1,547 |

| Minor metals | t | 918 | 899 |

| Platinum group metals (PGM) | kg | 8,821 | 9,335 |

Rod output significantly exceeds previous-year levels

Continuous cast wire rod is used as a preliminary product for processing, especially in the cable and wire industry, as well as for special semi-finished products. Demand for rod reflected an ongoing positive trend in the reporting year. Total rod output in the European market grew by over 4 % in the first half of 2018 compared to the previous year. Apart from catch-up effects from the previous year resulting from a change in cable sector standards, growth was supported by robust demand. The construction sector, the automotive industry, and the enameled wire industry provided demand momentum. There was also good demand for energy cable. In fiscal year 2017/18, there was stronger demand growth in our key European markets especially.

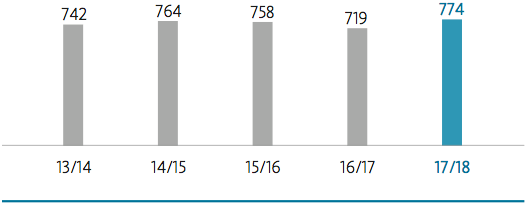

We gained additional market share in a good market environment. At 774,000 t, output from our rod plants significantly exceeded prior-year output (719,000 t) by 8 %.

Continuous cast rod output

in thousand t

Continuous cast shapes output at a very high level

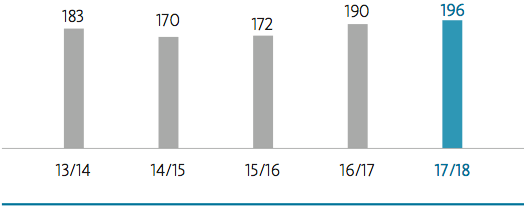

High European demand for flat rolled products led to a positive demand trend for high-purity shapes. At 196,000 t, shapes output in fiscal year 2017/18 was about 3 % higher than in the previous year (190,000 t).

Continuous cast shapes output

in thousand t

Bars and profiles output considerably increased

The production volume for bars and profiles, which are produced exclusively at the Olen site, amounted to 14,600 t, exceeding the previous year by 2,100 t or 17 % (previous year: 12,500 t). This increased sales volume was primarily attributable to the acquisition of new customers.

Capital expenditure

Capital expenditure in Segment MRP amounted to € 152 million (previous year: € 161 million). The main individual investments were infrastructure measures in Hamburg and Bulgaria, investments in the industrial heat project in the Hamburg neighborhood HafenCity East, and expansion measures in Bulgaria. The capital expenditure of the previous year was influenced by investments connected to long-term electricity sourcing.

Segment Flat Rolled Products

Key figures

| in € million | 2017/18 operating |

2016/17 operating |

| Total revenue | 1,452 | 1,348 |

| EBIT | 18 | 2 |

| EBT | 21 | 2 |

| Capital expenditure | 17 | 14 |

| Depreciation and amortization | -11 | -11 |

| Operating ROCE | 5.2 % | 0.7 % |

| Capital employed | 352 | 351 |

| Number of employees (average) | 1,768 | 1,746 |

Business performance and earnings trend

Segment Flat Rolled Products (FRP) processes copper and copper alloys – primarily brass, bronze, and high-performance alloys – into flat rolled products and specialty wire. The main production sites are Stolberg (Germany), Pori (Finland), Zutphen (Netherlands), and Buffalo (USA). Furthermore, the segment also includes slitting and service centers in Birmingham (UK), Dolný Kubín (Slovakia), and Mortara (Italy), as well as sales offices worldwide.

Segment FRP generated operating earnings before taxes (EBT) of € 21 million (previous year: € 2 million). The significant earnings improvement on the previous year was mainly thanks to the ongoing efficiency enhancement program, higher production and sales volumes, and a good market situation. Segment FRP therefore achieved the forecast issued at the end of fiscal year 2016/17.

Operating ROCE was 5.2 % (previous year: 0.7 %). Segment FRP therefore exceeded the forecast issued at the end of fiscal year 2016/17.

At € 1,452 million, the Segment’s revenues were notably above those of the previous year (€ 1,348 million). The higher revenues were primarily due to the increased sales volume and a higher average copper price for the products sold.

On March 29, 2018, Aurubis AG and Wieland-Werke AG signed a contract to sell Segment Flat Rolled Products. The final execution of the sales contract is subject to approval by the antitrust authorities. A final decision is expected in early 2019.

Product markets

The market for flat rolled products continued to develop positively in Europe in particular. Capacity utilization was good, while sales in the Segment increased by 3 % on the previous year. Growth momentum was especially evident among connector and cable manufacturers.

Raw materials

The availability and conditions for input metals were good in fiscal year 2017/18. The considerably lower metal prices in Q4 of the fiscal year didn’t lead to a bottleneck in the supply of input metals.

Production

Flat rolled products output increased

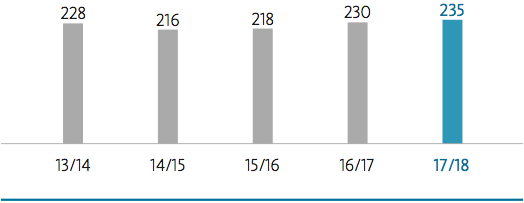

Output of flat rolled products and specialty wire increased to 235,325 t due to demand (previous year: 230,180 t). The boost in output was concentrated in the European plants. All of the sites continued to work on implementing the programs to improve efficiency and to enhance productivity and quality.

Flat rolled products and specialty wire output

in thousand t

Capital expenditure

Capital expenditure in Segment FRP amounted to € 17 million (previous year: € 14 million). This was primarily used for replacement investments.