Compensation report for the Executive Board and the Supervisory Board of Aurubis AG

The following compensation report is part of the Combined Management Report. It outlines the structure and level of the Aurubis AG’s Executive Board and Supervisory Board compensation.

Compensation for the Executive Board

The Supervisory Board defines the total compensation of the individual Executive Board members on the basis of proposals from the Personnel Committee and decides on and reviews the compensation system for the Executive Board at regular intervals.

In 2017, the Supervisory Board fundamentally revised the compensation system, working together with an independent external compensation expert. The new compensation system complies with the requirements of the German Stock Corporation Act (AktG) and the German Corporate Governance Code, particularly Section 4.2.3 of the German Corporate Governance Code. The participants of the Annual General Meeting approved the new compensation system pursuant to Section 120 (4) of the German Stock Corporation Act (AktG) on March 1, 2018.

Because of the responses of some investors, the Supervisory Board decided to change the composition of the annual bonus. The Supervisory Board passed a resolution on this adjustment on September 11, 2018.

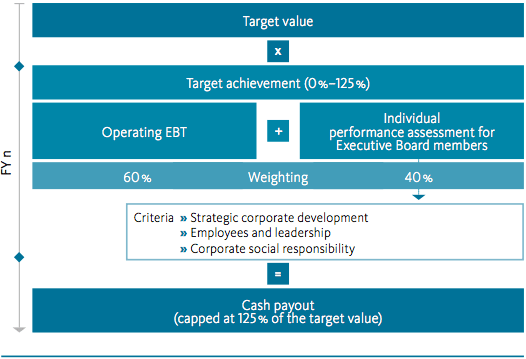

Specifically, as of October 1, 2018, the annual bonus is calculated with a higher weighting of 60 % (previously 50 %) according to the target set for the fiscal year for the operating EBT components, and a lower weighting of 40 % (previously 50 %) according to the assessment of the Executive Board member’s individual performance for the respective fiscal year.

In light of the fundamental revision of the German Corporate Governance Code (DCGK) and the German draft bill on transposing the second EU Shareholder Rights Directive (EU 2017/828, ARUG II), the Supervisory Board is currently refraining from further revision of the compensation system. Both the draft of the German Corporate Governance Code and the German draft bill on transposing EU 2017/828 include extensive regulations on compensation for the advisory bodies of exchange-listed companies. As of now, both the German Corporate Governance Code and the German law on transposing EU 2017/828 are expected to be passed in summer 2019.

Because the compensation system for Executive Board members will have to be reviewed, adjusted, and presented again at the Annual General Meeting anyway due to these developments, the company will refrain from taking a vote on the compensation system at the 2019 Annual General Meeting.

The new compensation system applies to Chief Financial Officer Mr. Rainer Verhoeven and to Chief Operating Officer Dr. Thomas Bünger, the latter of whom was appointed on October 1, 2018. For the Executive Board members Mr. Jürgen Schachler (until June 30, 2019) and Dr. Stefan Boel (Executive Board member until July 31, 2018), the old compensation system applies and will initially continue to apply.

Previous compensation system for the Executive Board

The compensation is defined in the employment contracts and consists of a series of coordinated compensation components.

Specifically, these components are fixed compensation, variable compensation, fringe benefits, and pension plans.

Fixed components

The fixed portion consists of fixed compensation, fringe benefits, and pension plans.

The annual fixed compensation amounts to € 600,000 for the Executive Board Chairman and € 420,000 for ordinary Executive Board members, and is paid out monthly in equal installments.

Additionally, the Executive Board members receive fringe benefits in the form of benefits in kind, which primarily consist of insurance premiums and company car use and are assessed according to tax guidelines.

Mr. Schachler and Dr. Boel receive defined contribution pension plans from the company. Annual contributions of € 140,000 for Mr. Schachler and € 100,000 for Dr. Boel are/were paid to an insurance company.

Both of these Executive Board members additionally have a defined contribution company pension plan. The pension plan is designed as a capital commitment. At the end of every fiscal year, € 120,000 for the Chief Executive Officer and € 80,000 for each ordinary Executive Board member is paid into liability insurances.

The respective Executive Board member can use the accumulated capital after reaching the age of 62 at the earliest – however, not before ceasing to be employed by the company.

Variable components

The old system of variable compensation includes two components, which are paid out annually. The first component (Component I) is dependent on achieving an annual target related to adjusted average consolidated EBT (earnings before taxes) for the Group for three years, and in each case relating to the current fiscal year and to the two fiscal years preceding it. The target is EBT derived from ROCE (return on capital employed) of 15 %. If the EBT is less than 40 % of the target, Component I is not paid. The target bonus from Component I can reach a maximum of 100 % (cap). The maximum amount that can be reached from these components in the case of 100 % target achievement is € 750,000 for the Chief Executive Officer and € 500,000 for each ordinary Executive Board member.

Component II stipulates an annual assessment of the joint (Component II a) and individual (Component II b) performance of the Executive Board by the Supervisory Board. Both components are based on a qualitative, criteria-supported assessment of sustainable company management. The target bonus from Component II can reach a maximum of 100 % (cap). A payout of a minimum of 50 % of the target bonus always occurs unless this is unreasonable within the meaning of Section 87 (2) of the German Stock Corporation Act (AktG). The maximum amount that can be reached from each of the Components II a and II b is € 250,000 for the Chief Executive Officer and € 175,000 for each ordinary Executive Board member.

The target bonus for Component I is 60 % of the total variable compensation; the target bonus for Component II is 40 %.

Premature termination

The employment contracts for the Executive Board members do not contain Change of Control clauses.

Explanation of the new compensation system for the Executive Board

The new compensation system also consists of fixed and variable components. The compensation structure includes maximum limits, both overall and with regard to its variable compensation components. The new compensation system applies to Chief Financial Officer Mr. Verhoeven and to Chief Operating Officer Dr. Bünger, the latter of whom was appointed on October 1, 2018.

The variable compensation components contain annual and multiannual components. The details of the various compensation components are as follows:

Fixed components

The fixed compensation components consist of fixed compensation, pension plans, and fringe benefits.

The annual fixed compensation amounts to € 420,000 for Mr. Verhoeven and is paid out monthly in equal installments.

The pension plans have not changed in comparison with the old compensation system.

Mr. Verhoeven receives an entitlement for the company pension plan in the form of a pension commitment. Aurubis AG’s contribution amounts to € 100,000 per year. The contributions are paid into liability insurances.

Mr. Verhoeven also has a defined contribution company pension plan in the form of a capital commitment. Aurubis AG’s contribution amounts to € 80,000 for him per year. Mr. Verhoeven can use the accumulated capital after reaching the age of 62 at the earliest – however, not before ceasing to be employed by the company.

Additionally, Mr. Verhoeven receives fringe benefits in the form of benefits in kind, which primarily consist of insurance premiums and company car use, and are assessed according to tax guidelines.

At its discretion, the Supervisory Board can grant special compensation for exceptional performance that is not covered by the regular compensation. This is stipulated in the employment contract. However, the total cap may not be exceeded. No special compensation was granted in fiscal year 2017/18. The Supervisory Board most recently granted one-time special compensation in fiscal year 2015/16 for additional interim duties performed in the Executive Board by Dr. Boel and Mr. Faust, the latter of whom served as Executive Board Spokesman until Mr. Schachler filled the vacant position of Executive Board Chairman on July 1, 2016.

Variable components

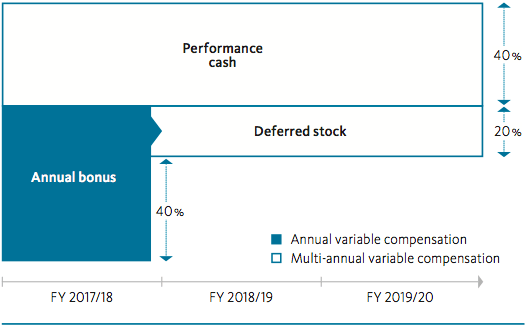

The system for variable compensation includes both annual variable compensation (annual bonus) and multiannual variable compensation, which is forward-looking. The multiannual, forward-looking variable compensation consists of both a “Performance Cash Plan” over three fiscal years and stock deferred over two fiscal years (virtual stock). The ratio of multiannual to annual variable compensation is 60:40.

Variable compensation

Annual bonus

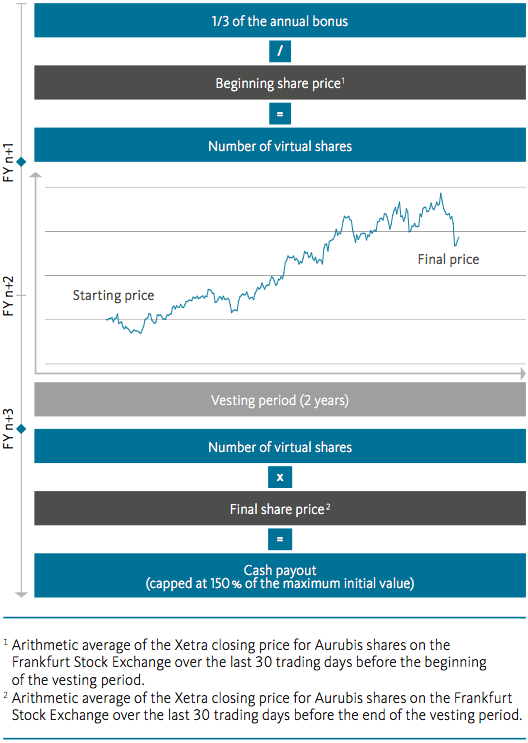

Two-thirds of the annual variable compensation (the annual bonus) is paid out after the end of the fiscal year and amounts to € 272,000 (max. € 340,000) for Mr. Verhoeven in the case of 100 % target achievement. The remaining one-third of the annual bonus is transferred to a virtual two-year stock deferral plan.

Until September 30, 2018, the annual bonus was calculated with a weighting of 50 % according to the target set for the fiscal year for the operating EBT components, and a weighting of 50 % according to the assessment of the individual performance for the respective fiscal year, both multiplied by the target value defined in the Executive Board contract.

Starting October 1, 2018, the annual bonus for Mr. Verhoeven is calculated with a weighting of 60 % according to the target set for the fiscal year for the operating EBT components, and a weighting of 40 % according to the assessment of the Executive Board member’s individual performance for the respective fiscal year, both multiplied by the target value defined in the Executive Board contract.

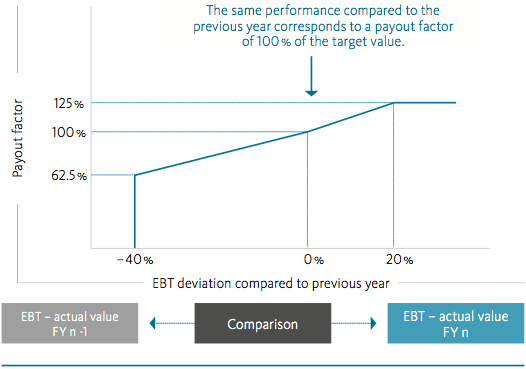

Annual bonus operating principle

Target achievement for the operating EBT is determined on the basis of an actual/actual comparison. The actual value of the operating EBT in the respective fiscal year is compared with the actual value of the operating EBT of the fiscal year preceding the current fiscal year (previous year). For an unchanged operating EBT compared to the previous year, the target attainment is 100 %. If the operating EBT is increased by 20 %, the maximum value of 125 % target achievement is reached. For an operating EBT of minus 40 % compared to the previous year, the minimum value of 62.5 % target achievement is reached. Target achievement between these points (62.5 %, 100 %, 125 %) is interpolated in a linear manner. If the maximum value is reached, further increases to the operating EBT do not lead to an additional increase of the target attainment. If the minimum value is not reached, the target attainment is 0 %. If the operating EBT is negative for both the previous year and the respective fiscal year, the Supervisory Board is authorized to set the target attainment according to its discretion. If a positive operating EBT was achieved in the previous year and a negative EBT in the respective fiscal year, the target attainment amounts to 0 %. The annual bonus rewards operating consolidated earnings growth and thereby a strengthening of the company’s profitability as compared with the previous year’s EBT.

Calibrating the performance targets – EBT

Individual performance is evaluated by the Supervisory Board and is based on criteria previously defined in the employment contract. Currently, strategic company development, employees and leadership, and corporate social responsibility are designated as criteria for assessing individual performance. The Supervisory Board can set the degree of target attainment between 0 % and 125 %. Furthermore, the Supervisory Board can, at its discretion, reduce the annual bonus in the event of extraordinary, unforeseeable developments (Section 87 (1) sentence 3 (second half of the sentence) of the German Stock Corporation Act).

The annual bonus stipulates a target value cap of 125 % for Mr. Verhoeven. Therefore, the annual bonus can amount to a maximum of € 510,000.

Two-thirds of the annual bonus is paid out directly after the end of the fiscal year. The last third is paid into the stock deferral, which is explained below. There is also a cap on the deferred stock payout.

Deferred stock

In order to guarantee a focus on stock for the variable compensation, one-third of the annual bonus flows into a virtual stock deferral plan. The stock deferral plan stipulates a two-year, forward-looking assessment basis and amounts to € 136,000 for Mr. Verhoeven in the case of 100 % target attainment.

The number of virtual shares at the beginning of the two-year vesting period is calculated by dividing one-third of the annual bonus by the starting share price. The starting share price is designated by the arithmetic average of the Xetra closing price for Aurubis shares on the Frankfurt Stock Exchange over the last 30 trading days before the beginning of the two-year deferral term.

Deferred stock operating principle

At the end of the two-year term, the number of virtual shares is multiplied by the closing share price. The closing share price also results from the arithmetic average of the Xetra closing price for Aurubis shares on the Frankfurt Stock Exchange over the last 30 trading days, this time before the end of the term. The resulting amount is paid out to the Executive Board members in cash at the end of the two-year term. However, the amount of the payout is limited to 150 % of the initial value (corresponding to one-third of the annual bonus). The payout from the stock deferral plan for Mr. Verhoeven is limited to € 255,000.

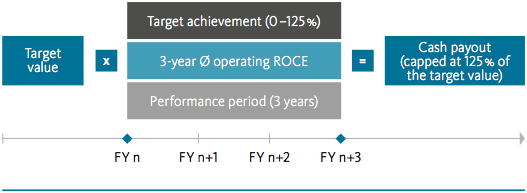

Performance Cash Plan

The Performance Cash Plan stipulates a three-year, forward-looking assessment basis. The relevant performance target is the average operating return on capital employed (ROCE) over the three-year period, as identified in the Annual Report. The amount paid out is calculated by multiplying the target set at the end of the three-year period for the operating ROCE by the target value of the Performance Cash Plan specified in the Executive Board contract. The target value currently amounts to € 272,000 for Mr. Verhoeven. The calculated amount to be paid out is limited to 125 % of the target and can therefore reach a maximum of € 340,000. Furthermore, the Supervisory Board can, at its discretion, reduce the Performance Cash Bonus in the event of extraordinary, unforeseeable developments (Section 87 (1) sentence 3 (second half of the sentence) of the German Stock Corporation Act).

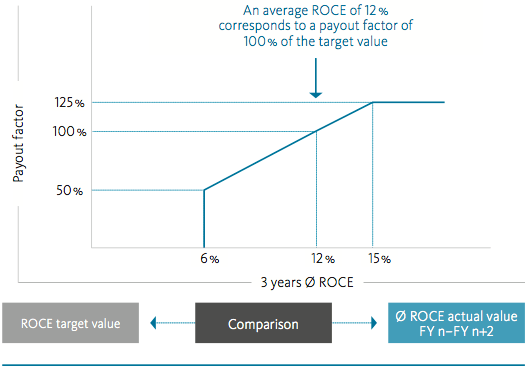

In order to determine the final target achievement for the Performance Cash Plan, the average operating ROCE achieved during the period (calculated annually after the respective fiscal years) is calculated at the end of the three-year period. The Supervisory Board determines an amount for 100 % target achievement (“target value”) for the average operating ROCE, as well as amounts for 50 % target achievement (“minimum value”) and 125 % target achievement (“maximum value”). The target value of the average operating ROCE for the three-year time period for the fiscal years from 2017/18 up to and including 2019/20 amounts to 12 %, with the minimum value being 6 % and the maximum value 15 %. The same target values also apply for the next three-year period from 2018/19 up to and including 2020/21. Target achievement between these points (50 %, 100 %, 125 %) is interpolated in a linear manner. If the minimum value is not reached, there is no payout from the Performance Cash Plan. If the maximum value is reached, further increases to the average operating ROCE do not lead to an additional increase of the target achievement. The Performance Cash Plan incentivizes the generation of a positive value contribution by means of an ambitious ROCE target range. The payout takes place at the end of the respective three-year period in cash.

Performance Cash Plan operating principle

Calibrating the performance targets – ROCE

Total cap

In total (fixed and variable components), compensation for Mr. Verhoeven is limited to an amount of € 1,355,000. Fringe benefits and benefit contributions from pension plans do not fall under the total cap.

Premature termination

In the event of a premature termination of an Executive Board position without good cause, a severance payment will be made within the scope of the new compensation system. Such payment is limited to two years’ total annual compensation in accordance with the German Corporate Governance Code recommendations, and does not provide compensation for any period longer than the remaining term of the employment contract. The employment contracts for the Executive Board members do not contain Change of Control clauses.

Amount of compensation for the Executive Board in fiscal year 2017/18

In total, compensation for active Executive Board members for activities in fiscal year 2017/18 amounted to € 3,812,280, including pension expenses (€ 570,000) and expenses for the virtual stock deferral plan (€ 93,149).

Dr. Boel left the company at the close of July 31, 2018 by amicable and mutual agreement with the Supervisory Board. The termination agreement includes the payment of the fixed and variable income components until July 31, 2018. The variable components will be paid out in January 2019. Moreover, Dr. Boel will receive a one-time gross payment of € 1,600,000. The contributions to the defined contribution pension commitment and the defined contribution company pension plan for Dr. Boel were paid proportionally until July 31, 2018.

The company has set up pension provisions on the basis of IFRS for the Executive Board members. In the reporting year, allocations to pension provisions for the active Executive Board members amounted to € 570,000. This amount comprises contributions to an external pension fund.

Former members of the Executive Board and their surviving dependents received a total of € 2,246,373 in fiscal year 2017/18, while € 27,403,439 (in accordance with HGB) and € 32,259,232 (in accordance with IAS) has been provided for their pension entitlements.

Individual details can be found in the following tables:

Benefits granted

Inflow

Compensation for the Supervisory Board

Supervisory Board compensation for fiscal year 2017/18

| in € Name |

Fixed compensation |

Compensation for committee membership |

Attendance fees | Total | |

| Prof. Dr. Fritz Vahrenholt | 2016/17 | 75,000 | 22,500 | 11,000 | 108,500 |

| 2017/18 | 162,945 | 44,489 | 17,000 | 224,434 | |

| Renate Hold-Yilmaz | 2016/17 | 150,000 | 25,000 | 14,000 | 189,000 |

| 2017/18 | 150,000 | 25,000 | 18,000 | 193,000 | |

| Andrea Bauer | 2016/17 | ||||

| 2017/18 | 20,753 | 1,706 | 2,000 | 24,459 | |

| Burkhard Becker | 2016/17 | 75,000 | 22,500 | 11,000 | 108,500 |

| 2017/18 | 31,233 | 9,370 | 10,000 | 50,603 | |

| Dr. Bernd Drouven | 2016/17 | 75,000 | 30,000 | 11,000 | 116,000 |

| 2017/18 | 31,233 | 12,494 | 6,000 | 49,727 | |

| Dr.-Ing. Joachim Faubel | 2016/17 | 75,000 | 0 | 5,000 | 80,000 |

| 2017/18 | 31,233 | 0 | 6,000 | 37,233 | |

| Prof. Dr.-Ing. Heinz Jörg Fuhrmann | 2016/17 | 225,000 | 50,000 | 12,000 | 287,000 |

| 2017/18 | 137,466 | 46,911 | 19,000 | 203,377 | |

| Karl-Heinz Hamacher | 2016/17 | ||||

| 2017/18 | 43,973 | 8,795 | 5,000 | 57,768 | |

| Prof. Dr. Karl Friedrich Jakob | 2016/17 | ||||

| 2017/18 | 43,973 | 13,192 | 9,000 | 66,165 | |

| Jan Koltze | 2016/17 | 75,000 | 15,000 | 9,000 | 99,000 |

| 2017/18 | 75,000 | 15,000 | 14,000 | 104,000 | |

| Dr. Stephan Krümmer | 2016/17 | ||||

| 2017/18 | 43,973 | 21,986 | 8,000 | 73,959 | |

| Dr. Elke Lossin | 2016/17 | ||||

| 2017/18 | 43,973 | 8,795 | 7,000 | 59,768 | |

| Dr. Sandra Reich | 2016/17 | 75,000 | 7,500 | 5,000 | 87,500 |

| 2017/18 | 75,000 | 11,898 | 13,000 | 99,898 | |

| Stefan Schmidt | 2016/17 | ||||

| 2017/18 | 43,973 | 8,795 | 8,000 | 60,768 | |

| Edna Schöne | 2016/17 | ||||

| 2017/18 | 21,986 | 2,199 | 1,000 | 25,185 | |

| Dr. med. Dipl.-Chem. Thomas Schultek | 2016/17 | 75,000 | 22,500 | 11,000 | 108,500 |

| 2017/18 | 31,233 | 9,370 | 6,000 | 46,603 | |

| Rolf Schwertz | 2016/17 | 75,000 | 0 | 5,000 | 80,000 |

| 2017/18 | 31,233 | 0 | 6,000 | 37,233 | |

| Melf Singer | 2016/17 | ||||

| 2017/18 | 43,973 | 4,397 | 5,000 | 53,370 | |

| Ralf Winterfeldt | 2016/17 | 75,000 | 22,500 | 8,000 | 105,500 |

| 2017/18 | 31,233 | 9,370 | 6,000 | 46,603 | |

| Dr.-Ing. Ernst J. Wortberg | 2016/17 | 75,000 | 37,500 | 11,000 | 123,500 |

| 2017/18 | 31,233 | 15,616 | 10,000 | 56,849 | |

| Total | 2016/17 | 1,125,000 | 255,000 | 113,000 | 1,493,000 |

| 2017/18 | 1,125,619 | 269,383 | 176,000 | 1,571,002 |

The compensation for the Supervisory Board was redefined at the Annual General Meeting with effect from October 1, 2015 and is governed by Section 12 of Aurubis AG’s Articles of Association. It is oriented towards the various demands of the Supervisory Board and its committees.

All Supervisory Board members receive fixed compensation of € 75,000 per fiscal year each, in addition to the reimbursement of expenses incurred while performing their duties. The Supervisory Board Chairman receives three times, the Deputy Chairman two times that amount.

Supervisory Board members who serve on the Personnel and/or Audit Committee additionally receive fixed compensation of € 15,000 per fiscal year per committee. Supervisory Board members who serve on the other Supervisory Board committees additionally receive fixed compensation of € 7,500 per fiscal year per committee. Supervisory Board members who chair a Supervisory Board committee receive twice that amount per fiscal year for each committee chairmanship.

The fixed compensation for committee activity is limited to € 25,000 per fiscal year for each Supervisory Board member, in accordance with Section 12 (2) of the Articles of Association. The limit for every committee chairmanship is € 50,000 per fiscal year.

Supervisory Board members who do not belong to the Supervisory Board or one of its committees for a full fiscal year receive compensation commensurate with the duration of their service.

Furthermore, Supervisory Board members receive an attendance fee of € 1,000 for each meeting of the Supervisory Board and of its committees attended.

On this basis, the Supervisory Board members received a total of € 1,571,002. Supervisory Board compensation for fiscal year 2017/18.

Hamburg, December 10, 2018

For the Executive Board

Jürgen Schachler Dr. Rainer Verhoeven

Chairman Member

The Supervisory Board

Prof. Dr. Fritz Vahrenholt

Chairman